The banking industry, like many others, is undergoing a significant transformation due to the rapid advancements in digital technology. The impact of this digital transformation is far-reaching, affecting every aspect of the banking sector from operations to customer experience and regulatory practices. This article explores the profound effects of digital transformation on the banking industry, with a particular focus on the technological advancements that are revolutionizing the sector, the implications for customer experience, and the regulatory challenges that digital banking presents.

Technological Advancements: Revolutionizing the Banking Sector

The banking industry is experiencing a technological revolution that is reshaping traditional banking practices. The emergence of FinTech companies, which leverage technology to offer innovative financial services, has been instrumental in driving this transformation. These companies have introduced disruptive technologies like blockchain, artificial intelligence (AI), and machine learning into the banking ecosystem, leading to the development of new banking models and services.

Blockchain technology, for instance, is being used to enhance transparency and security in banking transactions. It provides a decentralized ledger system that records transactions in a secure, transparent, and immutable manner. This technology has the potential to eliminate the need for intermediaries in banking transactions, reduce costs, and increase efficiency.

AI and machine learning, on the other hand, are being used to automate routine banking tasks, enhance risk management, and provide personalized banking services. For example, AI-powered chatbots are now being used to handle customer inquiries, while machine learning algorithms are being used to analyze customer data and predict future banking trends. These technologies are not only improving the efficiency and effectiveness of banking services but are also paving the way for more innovative banking solutions.

Customer Experience and Regulatory Implications in Digital Banking

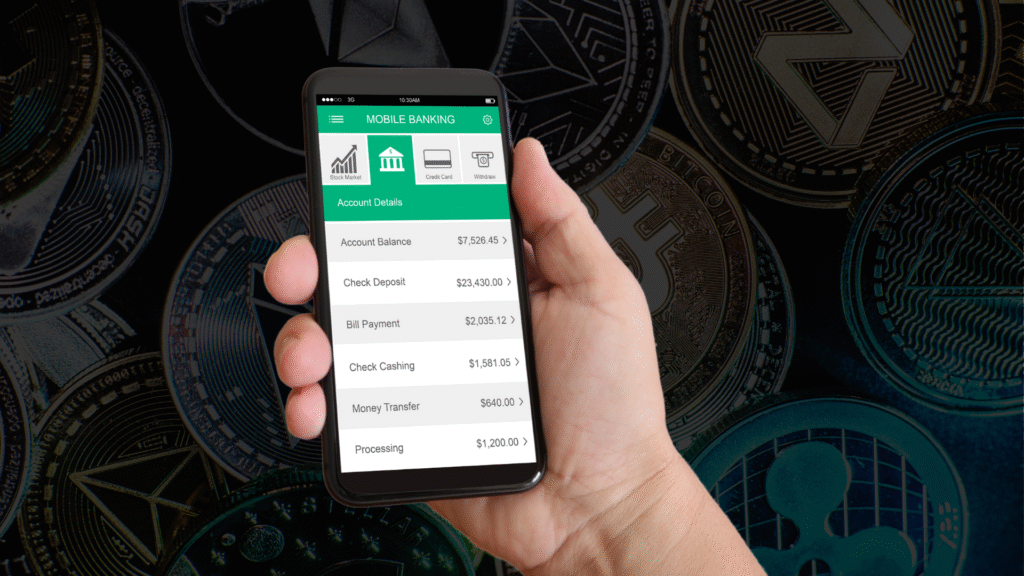

The digital transformation in the banking sector is also significantly improving the customer experience. Digital banking platforms are providing customers with convenient, fast, and secure banking services. Customers can now perform banking transactions from the comfort of their homes or offices, at any time of the day. This has not only increased customer satisfaction but has also led to an increase in customer engagement and loyalty.

Moreover, digital banking platforms are leveraging data analytics to offer personalized banking services. By analyzing customer data, banks can understand their customers’ needs and preferences, and tailor their services accordingly. This is leading to a more customer-centric approach in banking, where services are designed around the needs of the customer, rather than the needs of the bank.

However, the digital transformation in banking is also presenting new regulatory challenges. As banking transactions become increasingly digital, the risk of cyber-attacks and data breaches also increases. This has necessitated the development of robust cybersecurity measures and data protection regulations. Regulators are also grappling with the challenge of how to regulate FinTech companies, which operate outside the traditional banking regulatory framework. This has led to calls for a more comprehensive and flexible regulatory approach that can accommodate the unique characteristics of digital banking.

In conclusion, the impact of digital transformation on the banking industry is profound and far-reaching. Technological advancements are revolutionizing banking practices, leading to the development of new banking models and services. The customer experience is being significantly enhanced, with digital banking platforms providing convenient, personalized, and secure banking services. However, the digital transformation is also presenting new regulatory challenges, necessitating the development of robust cybersecurity measures and a more comprehensive regulatory framework. As the digital transformation continues to unfold, it is clear that the banking industry is set for a major overhaul that will redefine the way banking services are delivered and consumed.