In an increasingly competitive and rapidly evolving financial landscape, the effectiveness of marketing strategies is crucial in determining a firm’s success. The financial industry is unique in its marketing approach due to the nature of its services and the level of trust required from consumers. As such, a comprehensive understanding of the role of trust, digitalization, and compliance in marketing strategies is essential. This article delves into these pivotal aspects, shedding light on how they shape marketing strategies in the financial sector.

Understanding the Role of Trust in Financial Marketing Strategies

Trust plays an instrumental role in the financial industry. It is the foundation upon which financial relationships are built and sustained. Trust is not only vital in attracting new customers but also in retaining existing ones. A financial institution that is trusted by its customers is more likely to enjoy customer loyalty, which translates into sustained revenue streams. Therefore, marketing strategies in the finance sector should be designed around building and maintaining trust.

Trust in financial marketing strategies can be established and nurtured through transparency, reliability, and consistency. Transparency involves being open about the company’s operations, products, and services. It also entails being upfront about fees, risks, and potential returns. On the other hand, reliability refers to the ability of the financial institution to deliver on its promises. Consistency, both in service delivery and communication, reassures customers of the institution’s stability and reliability.

However, building trust goes beyond these aspects. It also involves demonstrating a clear understanding of customers’ needs and offering solutions that meet these needs. This requires a customer-centric approach in marketing strategies. By showing that they genuinely care about their customers’ financial wellbeing, financial institutions can foster trust, which ultimately leads to stronger customer relationships.

The Impact of Digitalization and Compliance in Finance Marketing

The digital revolution has significantly influenced marketing strategies across all industries, and the finance sector is no exception. Digitalization has not only changed how financial services are delivered but also how they are marketed. Financial institutions are leveraging digital platforms to reach a wider audience, engage with customers more effectively, and offer personalized services.

One of the key advantages of digitalization in finance marketing is the ability to collect and analyze vast amounts of customer data. This data can be used to gain insights into customer behavior, preferences, and needs. Consequently, financial institutions can tailor their marketing strategies to meet the specific needs of different customer segments. Additionally, digital platforms offer a cost-effective way of reaching and engaging with customers. They also provide a platform for financial institutions to showcase their products and services, engage with customers, and build brand awareness.

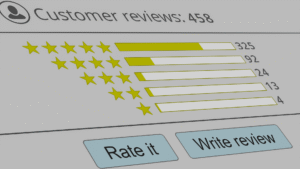

However, the digitalization of finance marketing also comes with its challenges. Compliance with regulations is one such challenge. As financial institutions increasingly use digital platforms for marketing, they must ensure that they adhere to the relevant regulations. This includes regulations regarding data protection, advertising standards, and anti-money laundering, among others.

Compliance in finance marketing is not only a legal requirement but also a crucial aspect of building and maintaining trust. By demonstrating compliance with regulations, financial institutions can reassure customers of their legitimacy and commitment to ethical practices. Therefore, compliance should be an integral part of any financial institution’s marketing strategy.

In conclusion, trust, digitalization, and compliance are pivotal aspects of marketing strategies in the finance sector. Trust is the foundation of customer relationships and can be built and nurtured through transparency, reliability, consistency, and a customer-centric approach. On the other hand, digitalization offers numerous opportunities for finance marketing, including the ability to reach a wider audience, engage with customers more effectively, and offer personalized services. However, it also brings about compliance challenges that must be addressed. Compliance is not only a legal requirement but also a crucial aspect of building and maintaining trust. Therefore, financial institutions must strike a balance between leveraging the opportunities presented by digitalization and ensuring compliance with regulations.